September

2008

Wireless local loop:

current status and future outlook

Summary of the results of the audit,

completed on 30 June 2008

Introduction

Licences for the deployment of public

wireless local loop (WLL) networks in the 3.4-3.6 GHz frequency band were

awarded by ARCEP on 25 July 2006, following a call for candidates launched in

August 2005.

These licences include deployment

obligations, whose first inspection deadline was 30 June 2008.

Over the course of summer 2008, ARCEP

performed an audit on these deployment obligations. It also held hearings to

achieve its analysis of the current status and future outlook for wireless

local loop projects in the 3.4-3.6 GHz frequency band.

The goal of this document is to render an

account of this audit and to provide a summary analysis of the situation, based

on the elements supplied by the players.

This report is composed of three parts:

·

a precise

inventory of rollouts as of 30 June 2008;

·

an analysis of

the technological and economic factors that have affected rollouts;

·

an updated view

of the wireless local loop’s development prospects.

1. Status as of 30

June 2008

1.1. Background

Between 2004 and July 2006, the Authority

held a call for candidates for regional wireless local loop licences in the

3.4-3.6 GHz frequency band in Metropolitan France and in the overseas regions

of Guyana, Saint-Pierre and Miquelon and Mayotte.

Following the public

consultation conducted by the Authority in 2004, whose purpose was to identify

the market’s interest in the wireless local loop in the 3.4-3.8 GHz

frequency band, the call for candidates for wireless frequency licences in the

3.4-3.6 GHz frequency band was launched in 6 August 2005 after publication by

the Ministry of Economy, Finance

and Industry of the order concerning the procedures and terms for awarding

frequency licences defined in ARCEP Decisions nos. 05-0646 and 05-0647 of 7

July 2005.

The Authority began the selection

procedure with a preparatory phase which included the submission of 175 letters

of intent from the candidates on 14 October 2005. This stage was to allow those

players interested in being awarded a licence to access the wireless local loop

to explore the different possibilities for sharing the use of the frequencies.

Once this stage was completed, in early

January the Authority established an inventory of the submissions to be able to

assess the possible scarcity of frequencies on a region-by-region basis. The 45

submissions received led to a determination of scarcity on 10 January 2006 in

22 regions in Metropolitan France, in Guyana and Mayotte, where selection

procedures had been officially launched. No scarcity of spectrum resources was

determined for Saint-Pierre and Miquelon. There were ultimately 35 players

selected as candidates.

Among these 35 candidates, 15 players

were selected, including six conseils régionaux (regional

councils), each with a 15MHz duplex. The selection procedure was based in equal

part on the following selection criteria:

·

contribution to

the national broadband development plan;

·

the

project’s capacity to stimulate broadband market competition;

·

the sum of the

fee that the candidate was willing to pay.

The selected candidates agreed to

large-scale rollout commitments which were included as obligations in the terms

of their licences.

The goal of the audit performed on 30

June 2008 was to assess the degree to which the licence-holders were meeting

their commitments, particularly in terms of deployment objectives.

This audit also provided an opportunity

to take an inventory of wireless local loop deployments and to get an updated

view of the players’ plans with respect to ADSL dead zone coverage and

the development of roaming services.

1.2. Licence holders as of 30 June 2008

The licences awarded by the Authority

concern frequencies that can be traded in the secondary market. This system has

been widely used by the original licence-holders. The transfers include not

only a transfer of rights but also of the original licence-holder’s

obligations. The following paragraph lists the licence-holders as of 30 June

2008 which were the subject of the audit.

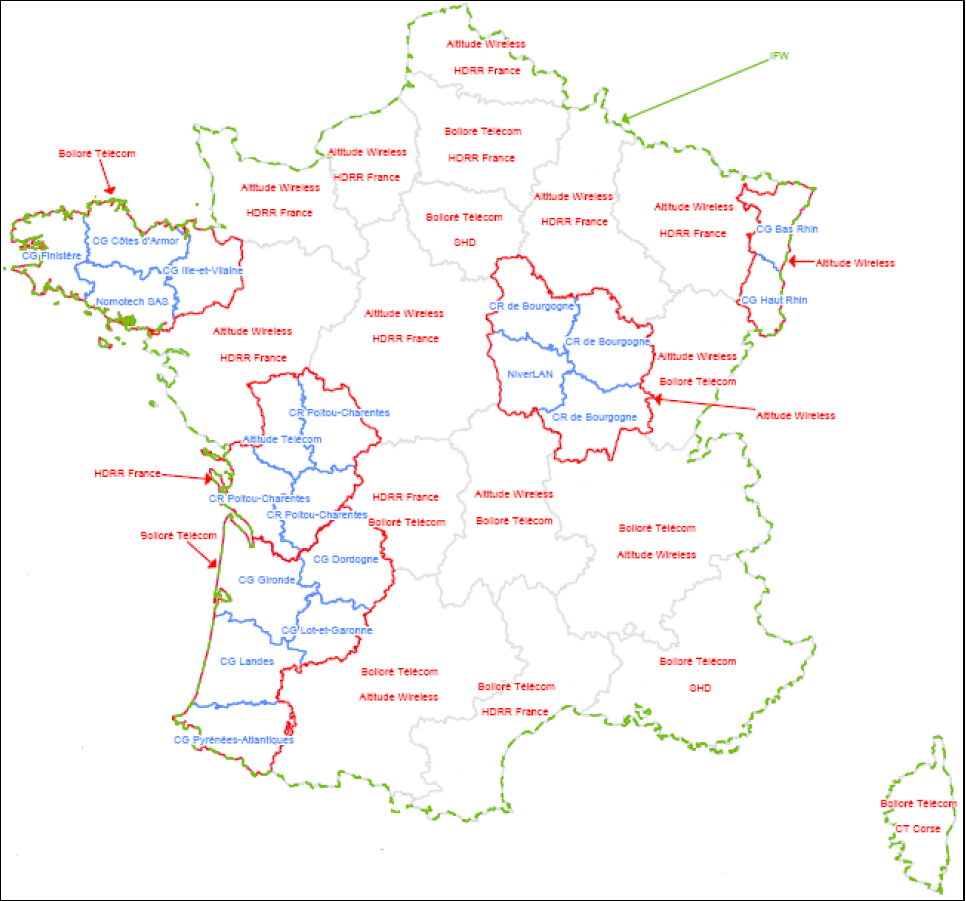

In Metropolitan France

As of 30 June 2008, the number of

licence-holders in Metropolitan France had practically doubled (19

licence-holders of which 14 local authorities and 5 operators) compared to the

10 original licence-holders (6 regional councils and 4 private operators).

The mechanisms of the secondary market

have been employed chiefly by the regional councils to cede their rights to the

conseils généraux (departmental councils). As a result,

the number of local authorities involved has increased considerably following

the transfers of frequency usage licences. 14 local authorities currently hold

a frequency licence.

In Alsace, the Conseil régional

transferred its licence to the Conseils généraux of the

Haut-Rhin and the Bas- Rhin in their respective départements. In

the same vein, in Aquitaine, the Conseil régional ceded its

licence to the five Conseils généraux (Conseils

généraux of the Gironde, the Dordogne, the Landes, the

Lot-et- Garonne and the Pyrénées-Atlantiques). Le Conseil

régional of Poitou-Charentes, which was initially a licence-holder

for the entire region, transferred a portion of its licence in the

Deux-Sèvres département to the firm, Altitude, and kept

its licence to the Charente region’s three other départements.

In Brittany, the Conseil régional ceded its licence to the Conseils

généraux of the Côtes d’Armor, the

Finistère and Ille-et-Vilaine in their respective départements,

and to operator Nomotech in the Morbihan département. The Conseil

régional of Burgundy transferred a portion of its licence to the

NiverLAN joint union in the Nièvre département, keeping

its licence to the rest of the region. And, finally, Corsica kept its original

licence.

The private operators that are

licence-holders are HDRR France, Altitude Wireless, Bolloré

Télécom, SHD and Nomotech SHD. HDRR France (formerly HDRR

multi-regions and HDDR Centre Est) has licences in 11 regions (Lower Normandy,

Centre, Champagne-Ardenne, Upper Normandy, Languedoc-Roussillon, Limousin,

Lorraine, Nord-Pas-de-Calais, Pays de la Loire, Picardie, Poitou-Charentes).

The company acquired all of the wireless local loop frequency licences from its

wholly-owned subsidiaries, HDRR Multi Regions and HDRR Centre- Est, on 30

November 2006. Altitude Wireless has a licence in 13 regions (Alsace, Auvergne,

Lower Normandy, Burgundy, Centre, Champagne-Ardenne, Franche-Comté,

Upper Normandy, Lorraine, Midi-Pyrénées, Nord-Pas-de-Calais, Pays

de la Loire, Rhône-Alpes) and Altitude Télécom has a

licence in the Deux Sèvres département. The company, Altistream

(renamed Altitude Wireless), a wholly-owned Altitude subsidiary, acquired all

of its wireless local loop frequency licences from the firm Maxtel, of which

Altitude controls 50%, on 7 June 2007 for 11 regions, and on 16 October 2007

for the two remaining regions: Franche-Comté and Rhône-Alpes.

Bolloré Télécom holds licences in 12 regions (Aquitaine,

Auvergne, Brittany, Corse, Franche-Comté, Ile-de- France, Upper

Normandy, Limousin, Midi-Pyrénées, Picardie,

Provence-Alpes-Côte d’Azur, Rhône-Alpes) and SHD (Neuf and

SFR subsidiary) in 2 regions (Ile-de-France, Provence-Alpes-Côte

d’Azur). And, finally, the firm Nomotech SAS has acquired a licence for

the Morbihan département.

After the 30 June 2008, ARCEP approved

the HDRR France plans to transfer licences to Bolloré

Télécom in 8 regions. At the outcome of this transfer, HDRR

France still held licences in three regions (Picardie, Languedoc-Roussillon and

Limousin) and Bolloré Télécom became the licence-holder in

20 of the 22 regions in Metropolitan France (all except Alsace and Burgundy).

These transactions illustrate two trends:

first, operators’ restructuring which has enabled the emergence of a

virtually nationwide operator and, second, a fragmentation at the departmental

level created by local authorities.

Lastly, operator IFW, which holds a

national licence whose deployment deadline is later than the rest (December

2008), will be audited at a later time.

Licence-holders’

use of wireless local loop frequencies in the 3.5GHz band as of 30 June 2008

Outside Metropolitan France

In 2006, licences were also awarded in

the geographical zones outside Metropolitan France. The following licence

holders were thus also subject to the audit:

·

France Telecom

(Saint-Pierre and Miquelon, Guyana and Mayotte)

·

Guetali (Mayotte)

·

Guyacom (Guyana)

·

Omtel SPM

(Saint-Pierre and Miquelon)

·

STOI (Mayotte)

·

Mediaserv

(Saint-Pierre and Miquelon)

1.3. Overall situation as of 30 June 2008

The audit of licence-holders’

compliance with the terms of their wireless local loop frequency licences,

which was performed two years after these licences were awarded, allows the

Authority to obtain an inventory of the first rollouts in the 3.4-3.6 GHz

frequency band. These rollouts involve a large number of sites (more than 500

operational sites). Commercial offers are also available and the first

customers (around 4,000 residential and business customers) have been connected,

especially in the less densely populated areas. Deployments nevertheless remain

small scale compared to what had been planned in 2006, and there are still

sizeable disparities from region to region (some are equipped with a large

number of sites while others have none) and from one licence-holder to the

next. On the whole, the current state of WLL deployments is well below the

licence-holders’ initial commitments.

In Metropolitan France

A total 526 sites have been deployed, of

which 512 are operational with a commercial offering either available or

scheduled to launch in the last quarter of 2008. HDRR France and Altitude

Wireless are reporting several thousand customers connected (business and

residential).

Three licence-holders have met their obligations

in terms of the number of sites to be deployed: the Conseil

général of the Haut-Rhin, the NiverLAN joint union

(Nièvre) and the firm Nomotech SAS (Morbihan).

Half of the local authorities that have

WLL licences are involved in a large-scale WiMAX rollout for which they have

appointed a technical partner and mobilised substantial financing, even if no

site has yet to be deployed. In many cases, the objectives for these projects

exceed those contained in their licence (in number of sites and breadth of

coverage).

The first commercial offers are

available. They are aimed at both residential users

(including services running at 2 Mbps downstream, 512 kbps upstream or 1 Mbps

downstream, 128 kbps upstream) and businesses (including services delivering 4

Mbps downstream, 1 Mbps downstream and 8 Mbps symmetrical), providing broadband

internet access at the same price as ASDL services, along with unmetered voice

services for residential users for an additional €10 euros a

month. Several thousand customers, both residential and business, already

subscribe to these offers.

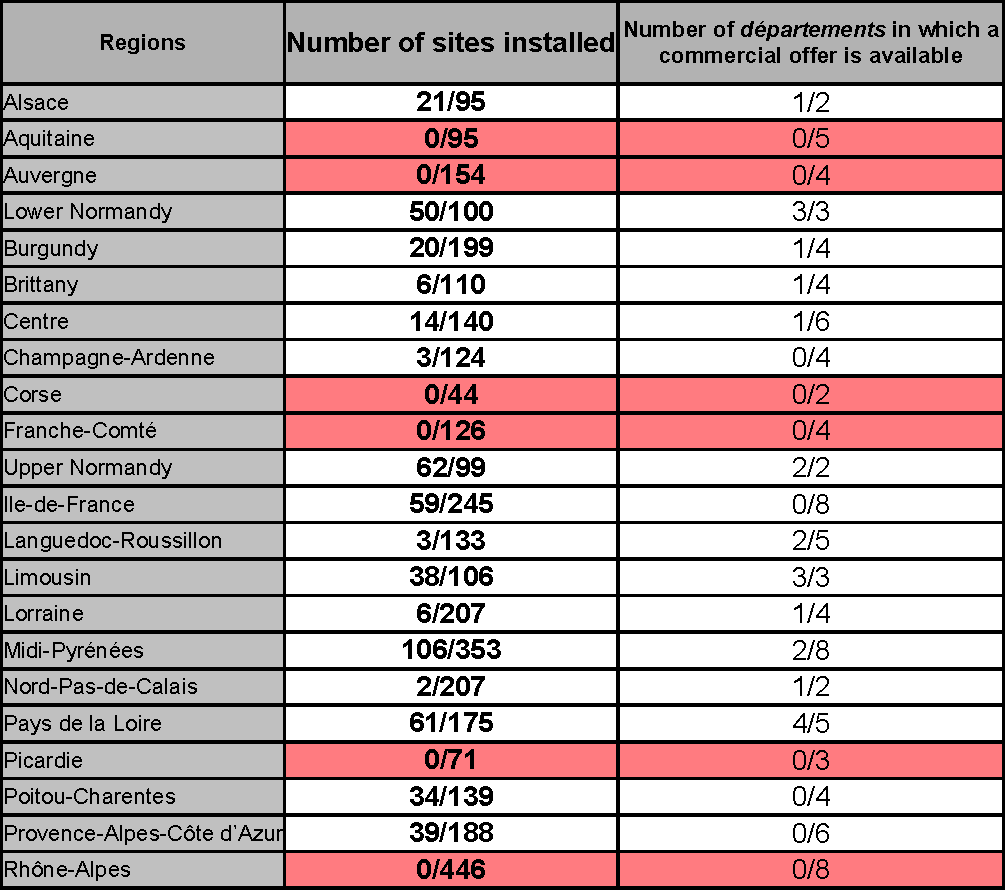

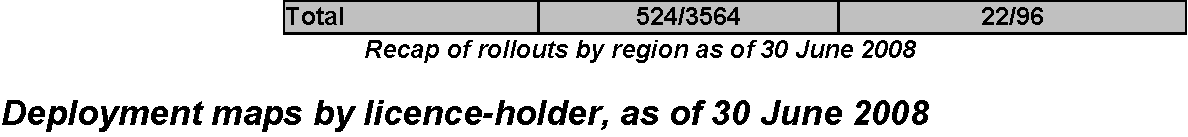

A regional inventory of rollouts reveals

that of the 22 regions in Metropolitan France, 16 are equipped with their first

sites and commercial offerings – the first rollouts having been achieved

by private sector licence-holders in 13 regions and by public authorities in

the other three. Pioneer deployments have taken place in a large percentage of

the country, albeit in a disparate fashion.

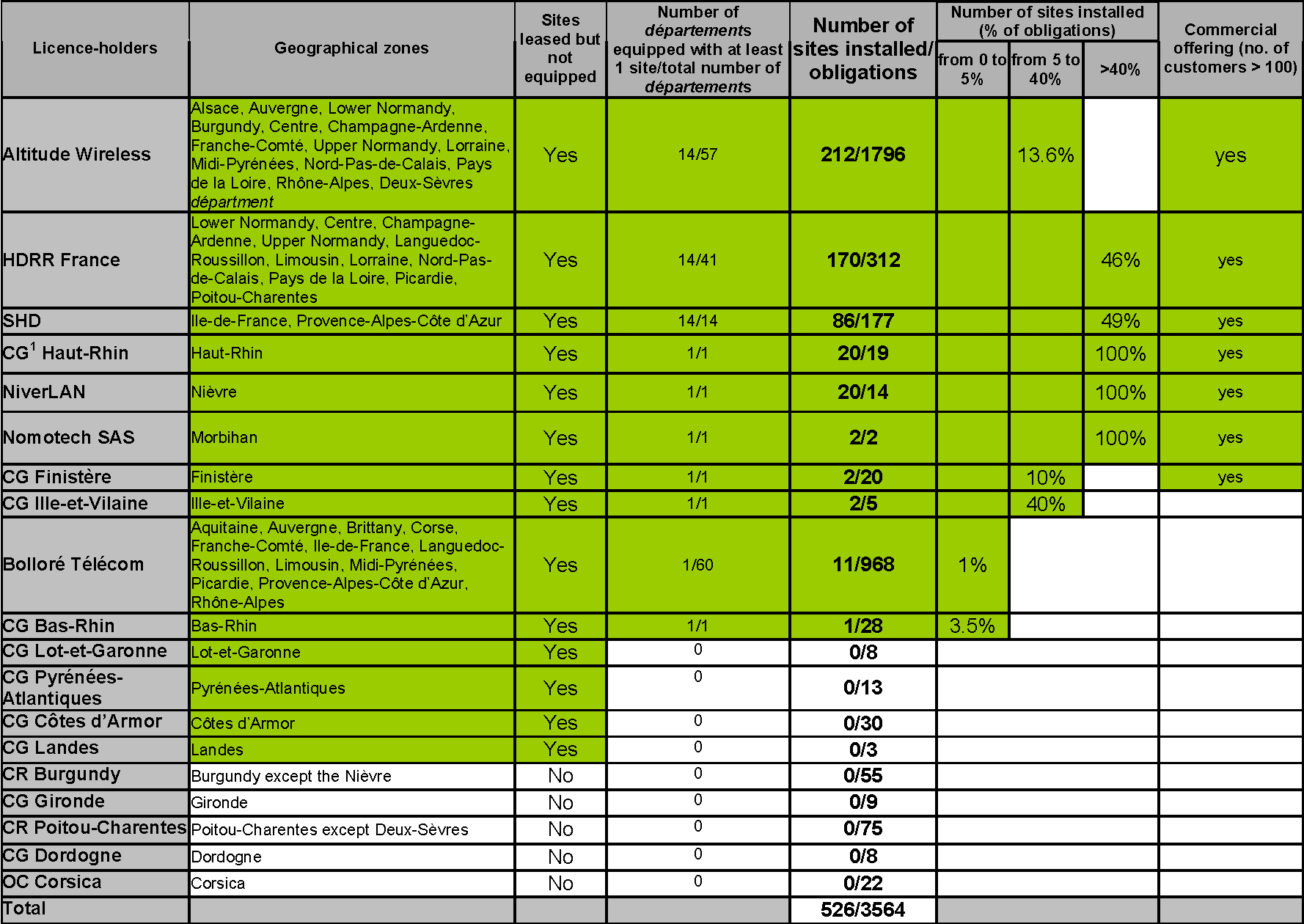

Figures on the rollouts are presented in

the tables below, which reveal, among other things that:

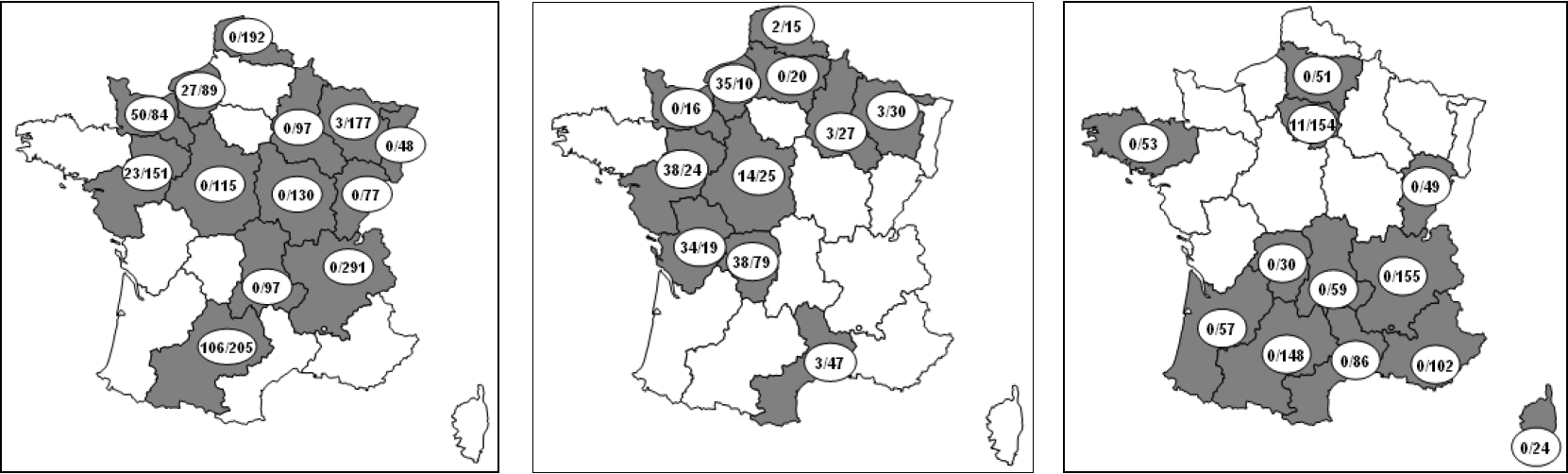

·

SHD has achieved

significant deployments in its two regions. Commercial launch is scheduled for

September 2008 (Numéo), and the wholesale offering has been available

since March 2007;

·

Altitude Wireless

has installed 212 sites in 7 regions and markets a commercial offer in four of

its 13 regions;

·

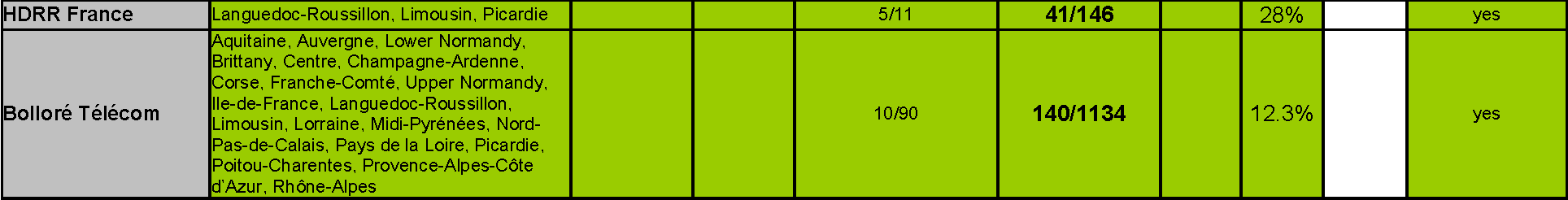

HDRR France has

transferred its licence in 8 regions. The company has met its obligations in

terms of number of sites to be deployed in three of these regions (Upper

Normandy, Pays de la Loire and Poitou-Charentes) and performed rollouts (63

sites) in the other regions, with the exception of Lower Normandy. In the three

regions where HDRR France has kept its licence, significant rollouts have taken

place in the Limousin where a commercial service is available (Numéo);

·

Bolloré

Télécom is testing its equipment and has deployed trial sites in

one of its 12 regions;

·

Nomotech SAS has

deployed two sites in accordance with its obligations as of 30 June 2008, and

the commercial launch of its services was scheduled for summer 2008.

The following tables provide a summary,

by licence-holder and by region, of the extent to which licence-holders’

obligations had been met as of 30 June 2008 in terms of:

·

scale of

deployment (number of sites);

·

proper use of

frequencies. This obligation translates into the presence of at least one

operational site and the availability of a commercial offering in each département.

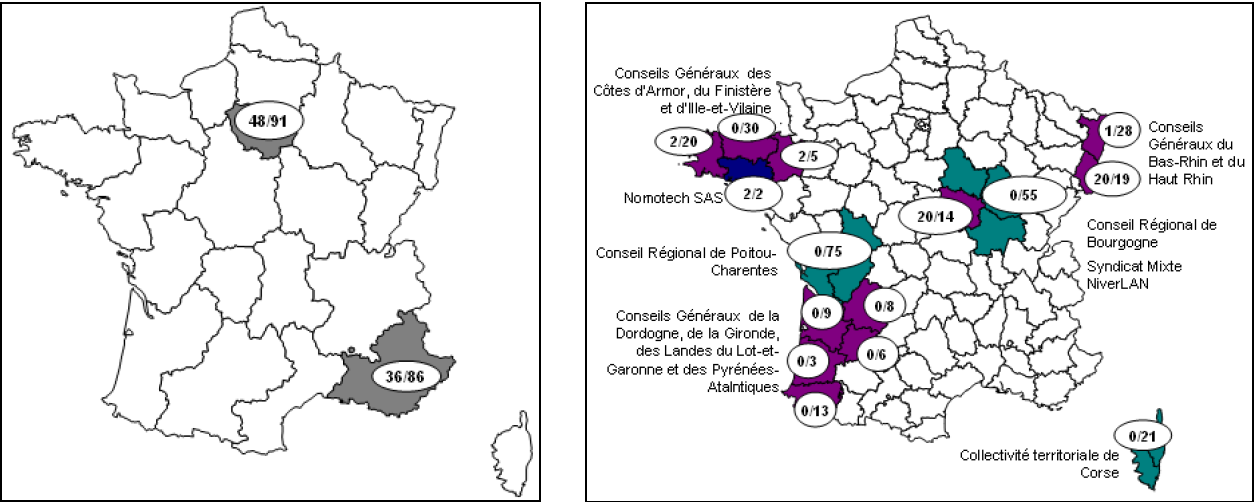

Recap of licence-holder rollouts as

of 30 June 2008

1 CR: Conseil régional (Regional Council),

CG: Conseil général (Departmental Council), OC: Overseas

collectivity

Following

the HDRR France transfer of 8 licences to Bolloré Télécom:

HDRR France and Bolloré

Télécom rollouts following transfers

The information supplied by the licence-holders

also made it possible to assess deployments in each region:

9/19

![]()

Altitude

Wireless HDRR France Bolloré Télécom

10/19

SHD Local authorities and Nomotech SAS

11/19

The situation from one

operator to the next is very disparate, with some licence-holders having not

yet begun their deployments while others are altering their strategies, such as

HDRR France which, although it had deployed sites, transferred 8 of its 11

licences to Bolloré Télécom which is continuing its trials

and waiting for terminal equipment to be available in large volumes before undertaking its rollouts. SHD

has completed around half of its planned deployments, and has been marketing a

wholesale offer since March 2007.

And, lastly, Altitude Wireless is

continuing its rollouts but only as part of projects financed by local

authorities (whose role in the development of the wireless local loop is

addressed in section 2.3.5).

Some local authorities, notably the Conseil

général of the Dordogne and the overseas collectivity of

Corsica, have opted for another broadband access technology – namely dead

zone subscriber connection points or NRA-ZO (Nœuds de Raccordement

Abonnés Zones d’Ombre).

Outside Metropolitan France

Deployments in Guyana have been achieved

chiefly by Guyacom (5 operational sites and some 15 businesses connected) and

France Telecom (2 sites installed but not operational). In Mayotte, Guetali has

met its obligations and has a base of around 100 business customers. In

Saint-Pierre and Miquelon, two France Telecom sites are operational.

2. Analysis of

technological and economic factors

The results presented in the previous

chapter provide a quantified illustration of wireless local loop deployments

– clearly revealing the disparities amongst licence-holders. The goal of

this chapter is to present the elements supplied by licence-holders in their

responses which justify the differences in the status of their projects’

timetables.

The chief reason for being behind

schedule cited across the board is terminal equipment delays in terms of both

availability and technological maturity. This factor has a more or less significant

impact on rollouts, depending on the service (fixed or roaming) and the planned

business model.

The first section in this chapter

examines the technological maturity and availability of the equipment. The

second paragraph then assesses the impact on business models and explores the

other factors that influence these models.

2.1. Technological maturity and high volume availability

The technologies currently employed to

develop the wireless local loop in the 3.4-3.6 GHz frequency band belong to the

802.16 family of standards defined by the IEEE and referred to commonly as

WiMAX (Worldwide Interoperability for Microwave Access). Only the two

latest versions (d and e) are currently being used.

• 802.16d version of WiMAX

enabled connection of the first customers in rural areas

Version 802.16d has proven itself as a

technology that works for delivering a fixed WLL service. It had the advantage

of being mature and available. This technology was used for pioneer fixed

rollouts back in 2006 and later by local operators developing their own

equipment based on this standard.

• …but the market

worldwide shifted to the more promising 802.16e standard

Market players around the globe, both equipment

manufacturers and operators, have switched to the next version of WiMAX

technology, namely 802.16e. Introduced later than anticipated, this technology

– which enables roaming and announces better performance along with

economies of scale at the global level – proved persuasive for most

market players, including those wanting to provide a fixed service.

Mobile equipment manufacturers in

particular began developing 802.16e-based products, and the entire market is

now centred around the technology.

Meanwhile, version 802.16d is currently

the focus of developments by only a handful of local players and by

manufacturers offering hybrid 802.16d and 802.16e products that enable current

installations to make the transition.

Operators in France thus elected to

follow the same path as the global market.

• First 802.16e-based

deployments are underway …

With the exception of a few local

operators, current deployments are all being performed using the 802.16e norm,

including those by operators whose first rollouts were based on 802.16d.

As it stands, a great many manufacturers

are able to supply a large volume of base stations and terminals for fixed

usage (with rooftop antenna).

The terminal equipment needed to enable

roaming usage (PCMCIA cards) are just now becoming available.

• … but 802.16e

technology does not yet deliver the announced level of performance…

According to operators, the performances

by currently available equipment are below forecasts. In particular, coverage

is 10% to 20% lower for an equivalent number of base stations, and indoor use

is highly compromised by the equipment’s lack of maturity. Rollout budget

forecasts were thus revised as a higher

13/19 number of base stations is needed

to achieve the same coverage as what was stated in the licence-holders’

submissions.

In addition, according to one operator,

the equipment’s current state of maturity still makes it impossible to

provide a high quality telephony service using 802.16e.

• …and the equipment is

not interoperable

One major obstacle cited by the WLL

frequency licence-holders is the lack of interoperability between the terminals

and the base stations employed for fixed usage, and no doubt for roaming as

well. This lack of interoperability forces the players to perform more costly

rollouts using a single supplier, added to which investments made to date may

well be undermined if future equipment upgrades are needed.

WiMAX Forum certification of technical

solutions has fallen behind schedule, with the timetable set in July 2006

indicating certification of the first equipment by the end of that year. This

first wave of certification for equipment operating in the 2.6 GHz frequency

band did not, in fact, occur until June 2008, and certification of 3.5 GHz-band

equipment is now scheduled for late 2008 or early 2009.

This roadmap illustrates not only delays

in manufacturing but also the fact that the development of equipment operating

in the 3.4-3.6 GHz frequency band is closely bound up with the development of

analoguous equipment operating in the 2.6 GHz band.

The future of this technology goes beyond

just France, of course, and will be decided at the global level according to

the leading manufacturers’ and operators’ commitments to

large-scale projects in the 2.6 GHz and 3.5 GHz frequency bands.

2.2. Business models and windows of opportunity

When the WLL licences were delivered, two

types of project had been identified for use of the 3.4-3.6 GHz band:

·

contribution to

developing broadband coverage nationwide, particularly in those zones not

covered by ADSL;

·

innovative

endeavours in the area of roaming between fixed and mobile broadband,

particularly in densely populated areas.

Both types of project are still on the

table. Current wireless local loop deployments are focused on fixed usage, with

pioneer rollouts and the launch of commercial services having been supported by

public-initiative networks, for projects in sparsely populated areas, as a

complement to zones covered by ADSL. WiMAX technology is, however, having to

compete with new technological solutions such as the NRA-ZO (dead zone

subscriber connection points) as well as proven technologies such as satellite

and Wi-Fi.

In densely populated zones, as a solution

for delivering broadband wireless roaming, WiMAX provides the market with

innovative services between fixed and mobile broadband. But the below-par

performances of the equipment thus far, the lack of suitable terminals and the

lack of interoperability have all contributed to delaying rollouts.

These points are examined below.

2.2.1. WiMAX for regional digital development in dead zones

Licence-holders that have been working to

equip dead zones underscore the fact that public-initiative networks have been a

significant driving force in WLL rollouts in these areas. The majority of

launches in Metropolitan France in fact occurred as part of a public-initiative

network.

Economic fragility confirmed

Players with a WLL licence in the 3.5 GHz

frequency band confirm the fragility of a business model for operations solely

in dead zones and reveal that, without public financing, this model will not

likely be viable. Furthermore, the economic area is stretched to the point that

it cannot sustain two players in the same dead zone. As a result, regardless of

the technology used, when a public-initiative network is underway, other

players’ rollouts are discouraged, and so preventing the introduction of

a competing offer.

A national model aimed solely at covering ADSL dead zones does not seem viable

HDRR France’s withdrawal

demonstrates that it was unable to achieve economic viability with a

multi-regional coverage model aimed only at those zones still not covered by

ADSL. In addition to delays with the technology, the reasons cited by the

operator are the introduction of the NRA-ZO solution and the fragmentation of

the target market which resulted in the multiplication of public-initiative

networks.

The extension of ADSL coverage enabled by

the development of the NRA-ZO (dead zone coverage) solution reduces the size of

the potential zone to be covered by WLL technologies. The NRA-ZO solution is

positioned as a direct rival for WiMAX from an economic standpoint. The NRA-ZO

connection points are being installed on the border of zones covered by ADSL.

On the whole, a dead zone subscriber connection point installed in these zones

captures around 25% of the lines in the target market, without reducing the

quantity of WiMAX equipment (particularly base stations) that needs to be

installed to ensure coverage in the remaining areas. As a result, the economic

potential of WiMAX is seriously undermined while its required investments in

infrastructure remain the same.

Furthermore, some licence-holders pointed

out that the fragmentation caused by public-initiative networks reduces the

size of the potential market for a national player, and so the potential

economies of scale. This fragmentation also undermines the ability to achieve a

homogenous and consistent marketing model. In particular, when marketing a

wholesale offer, this fragmentation discourages ISPs from offering a service

that would not be national or, at least, as widely available as possible. The

customers for these wholesale offers are thus local ISPs (rarely operating beyond

the departmental or multi-department level) which, for a national operator,

generates additional costs for structuring and connecting to the information

system.

Public authority financing for dead zone

coverage projects helps rebalance this business model. Operators nevertheless

indicate that the financing is sometimes accompanied by targets that well

exceed the initial obligations contained in their WLL frequency licences.

Moreover, financing that takes account only of the initial investment may not

be enough to cover the cost of future technological developments.

And, finally, operators with a WLL

licence underscore the fact that public-initiative network contract models are

often complex and that the generally long timelines cannot be managed efficiently

so as to keep up with technological developments.

This being the case, local authorities

have a central role to play in the digital development of their region in

general, and in WiMAX deployments in particular: this point is examined in more

detail in section 3.3.2.

2.2.2. WiMAX for ISPs’ national

roaming projects

WiMAX technology, and the 802.16e

standard in particular, was developed to enable roaming, and even mobile

broadband access. By choosing this version of the norm, some operators’

licence submissions included the fact that they wanted to help develop

broadband market competition nationwide, and particularly in densely populated

areas, with innovative roaming solutions.

Operators pointed out that the roaming

equipment (PCMCIA cards, USB keys) required was in very short supply, and even

non-existent when it came to 3.5 GHz chips embedded in PCs, added to which this

equipment – whose production was already some 24 months behind schedule

– is not interoperable.

The combination of

these two factors is currently preventing operators from deploying networks

that enable roaming services under viable economic conditions (the lack of

interoperable equipment prevents the creation of a mass market and puts a halt

to investments by operators which will undoubtedly have to upgrade their base

stations once the terminal equipment has been certified).

Furthermore, projects in the 3.5 GHz band

aimed at delivering roaming services are now having to contend with the

development of 3G mobile broadband offerings and, in future, with new projects

born of the upcoming availability of the 2.6 GHz and 800 MHz frequency bands.

The following chapter presents the

players’ updated perspective on the development outlook for the wireless

local loop, and identifies a number of factors that will help stimulate its

development.

3. Outlook for

projects in the 3.5 GHz frequency band

This chapter is devoted to the outlook

for wireless local loop projects in the 3.5 GHz frequency band, as presented by

the players. The first part contains an analysis of the role that the WLL in

the 3.5 GHz band will play in the broadband access market. The second part

describes the factors that will be key to its development.

3.1. Role of the

wireless local loop

Despite a rocky start, the audit

performed with the players confirmed the existence of projects based on two

very different models:

·

nationwide

projects for delivering roaming services in densely populated zones;

·

regional digital

development projects.

A national ISP model for a roaming

broadband wireless internet access service

The recent consolidation of operator

Bolloré Télécom illustrates a tendency to develop a

national strategy aimed at delivering roaming broadband wireless internet

access in densely populated areas, and confirms the market’s interest in

developing this type of project.

The Bolloré Télécom

wireless local loop project underscores the operator’s interest in WiMAX

technology. The project involves sizeable investments and aims to build a

strong nationwide brand with commercial offerings that benefit from economies

of scale and consistent service thanks to the national dimension.

Providing a wireless local loop service

nationwide would prove an appealing alternative or complementary solution to

DSL technologies, particularly for roaming access to services.

To succeed, however, this type of

business model would need to forge itself a place between fixed broadband

access offers and mobile broadband access offers.

A digital regional development

component in the projects

There does not appear to be a viable

business model for using wireless local loop technology in the

3.5 GHz frequency band only for

delivering fixed broadband access in zones not yet covered by ADSL or cable.

Given that the rollouts performed as part

of a nationwide ISP model will initially target densely populated zones,

covering dead zones with services in the 3.5 GHz band seems an unlikely

prospect in the short to medium term, outside a local public-initiative network

project.

Here, WLL technologies in the 3.5 GHz

frequency band could contribute to achieving national coverage as part of

projects that employ a combination of technologies. It does seem that no single

technology – whether wireless local loop, wireline technologies or

satellite systems – can single-handedly meet the goal of expanded

coverage.

It is only by examining the local

situation on a case-by-case basis that the optimal combination of technologies

can be found to resolve a digital regional development problem.

Each alternative to the wireless local

loop has its own set of advantages and disadvantages. The NRA-ZO solution, for

instance, which targets dead zones, does not always meet the client

enterprise’s needs in terms of service as most businesses require

guaranteed symmetrical bitrates. Satellite solutions have inherent technical

limitations and remain costly for the speeds they deliver, although

technological progress is expected in the coming years, as is a decrease in

price. Wi-Fi is an easy, fast and inexpensive solution to install, but it is

only temporary – one of its weaknesses being that it cannot guarantee

quality of service. And, finally, optical fibre solutions which are competitive

in densely populated zones, only serve as a collection network component in

more sparsely populated areas and, using WiMAX as the access solution,

constitute an intermediate stage in delivering fibre to the user.

The issue of regional digital development

is examined briefly in this document, but will be the subject of a detailed

ARCEP report, in accordance with the law on modernising the economy (Loi de

Modernisation de l’Economie).

1. Development factors

2. Global production situation

Widespread use of the wireless local loop

in the 3.5 GHz frequency band depends to a considerable extent on the

large-scale and global availability of WiMAX 802.16e standard-compliant

equipment that is interoperable and that performs as expected.

This availability depends a great deal on

the existence of a large enough worldwide market that projects in France alone

cannot create.

Equipment availability

All of the WLL frequency licence-holders

emphasised the impact of production delays in WiMAX equipment for the 3.5 GHz

frequency band.

802.16e equipment for fixed usage is currently

available, albeit carrying certain concerns over its interoperability with

future hardware. Certification of the first roaming-compatible equipment in the

2.6 GHz band was the subject of a WiMAX Forum communiqué in June 2008,

and equipment in the 3.5 GHz band is expected to be certified in late

2008-early 2009. The timetable is thus a positive sign of the development of

WiMAX technology.

According to the manufacturers, equipment

in the 3.5 GHz band will become available 6 to 12 months later than 2.6 GHz

band equipment. This means that both public and private sector players will

need to establish a technological plan that depends on developments around the

globe, and so contains a portion of risk.

One key to successful projects will thus

be the massive release of interoperable equipment, for both fixed and roaming

usage. Its interoperability will lift the current restriction of having to rely

on a single supplier.

In addition, operators need to continue

to work to promote the development of the equipment, particularly by taking an

active part in initiatives such as those being undertaken by the WiMAX Forum.

Technological evolution

As it stands, equipment performance

levels vary from one manufacturer to the next. Of particular note is the fact

that some manufacturers’ products do not provide high enough quality to

deliver a telephone service. Manufacturers and operators are working together,

notably within the WiMAX Forum, to improve the hardware’s performance.

The next generation of base stations and terminals is expected to deliver more

robust wireless performance. Ongoing progress towards producing more robust and

high performance equipment is thus another crucial factor for the future

success of WiMAX in the 3.5 GHz band.

The situation worldwide

802.16e technology has the advantage of

being the focus of production worldwide, which will only materialise from

demand for large-scale projects. Uncertainties at the global level thus have a

direct impact on equipment availability. In addition, the development of

WiMAX-based equipment is focusing first on the

2.6 GHz band. WiMAX in this frequency

band has a relative lead over 3.5 GHz-band equipment because of the

geographical scope of the projects (in Asia and the United States). As a

result, manufacturers naturally began by developing technical solutions in the

2.6 GHz band, which meant that 3.5 GHz band WiMAX developments were forced to

take a backseat.

Mass production therefore depends, first,

on manufacturers’ commitment and, second, on the existence of

operators’ large-scale projects.

3.2.2. The role

of local authorities in digital regional development projects

In the short and medium term, the use of

WiMAX in the 3.5 GHz band for covering ADSL dead zones will be shaped largely

by their inclusion in public-initiative networks.

The crucial factors that can help

encourage the use of this type of technology are:

·

the availability

of a backbone network, e.g. optical fibre, which can be accessed under neutral

and non-discriminatory conditions by all operators, allowing them to deploy

their local loop quickly and at a lower cost. Investments induced by the

construction of a backbone network have the added advantage of being lasting;

·

the availability

of high points.

Local authorities’ commitments to making

this type of lasting investment is one of the factors that will enable the

deployment of wireless local loop technologies, while not being specific to

WLL.

Furthermore, the role

played by the wireless local loop in the 3.5 GHz band as part of a combination

of technologies needed for digital regional development can be assessed at the

local level, based on an inventory of the zones concerned and an

technical-economic optimisation aimed at determining the solution that is best

suited to each case.

If one of the solutions

identified includes WiMAX, whether or not the local authority has a WLL

licence, the deployment of a digital regional development project based on

WiMAX could be facilitated if the local authority takes account of the

operating costs and the costs generated by technological developments (evolving

standards and equipment upgrades) during the financial planning stage.

Conclusion

Over the course of summer 2008, ARCEP

performed an audit of the rollout obligations for public wireless local loop

networks in the 3.4-3.6 GHz frequency band. The hearings that were held

concurrently made it possible to assess the circumstances affecting the

development of wireless local loop projects in the 3.4-

3.6 GHz band and to obtain an updated

view of the market.

The first point noted is the actual

deployment of the wireless local loop in over 500 sites, along with the

availability of commercial offers and several thousand residential and business

customers. Rollouts remain still relatively small-scale, however, and currently

fall well short of the licence-holders’ original commitments. This

situation can be explained in large part by the undeniable production delays

worldwide of interoperable 802.16e standard equipment, whose outlook is more

promising and towards which the market is currently oriented.

Widespread use of the wireless local loop

in the 3.5 GHz frequency band depends to a considerable extent on the

large-scale and global availability of WiMAX 802.16e standard-compliant

equipment that is interoperable and that performs as expected. This

availability depends a great deal on the existence of a large enough worldwide

market that projects in France alone cannot create.

It emerged from the players’ views

on the outlook for their projects that the wireless ISP model devoted to

providing nationwide roaming broadband services is still very much on the

table. To succeed, this type of business model will need to forge itself a

position between fixed broadband and mobile broadband access offers.

Among other things, wireless local loop

technologies in the 3.5 GHz frequency band could contribute to regional digital

development projects, as one component in a combination of technologies. It

does seem that no single technology – whether wireless local loop,

wireline technologies or satellite systems – can singlehandedly meet the

goal of covering all of the country’s dead zones. The economic viability

of a WiMAX project aimed specifically at dead zones does, however, appear

unlikely outside their inclusion in public-initiative networks.